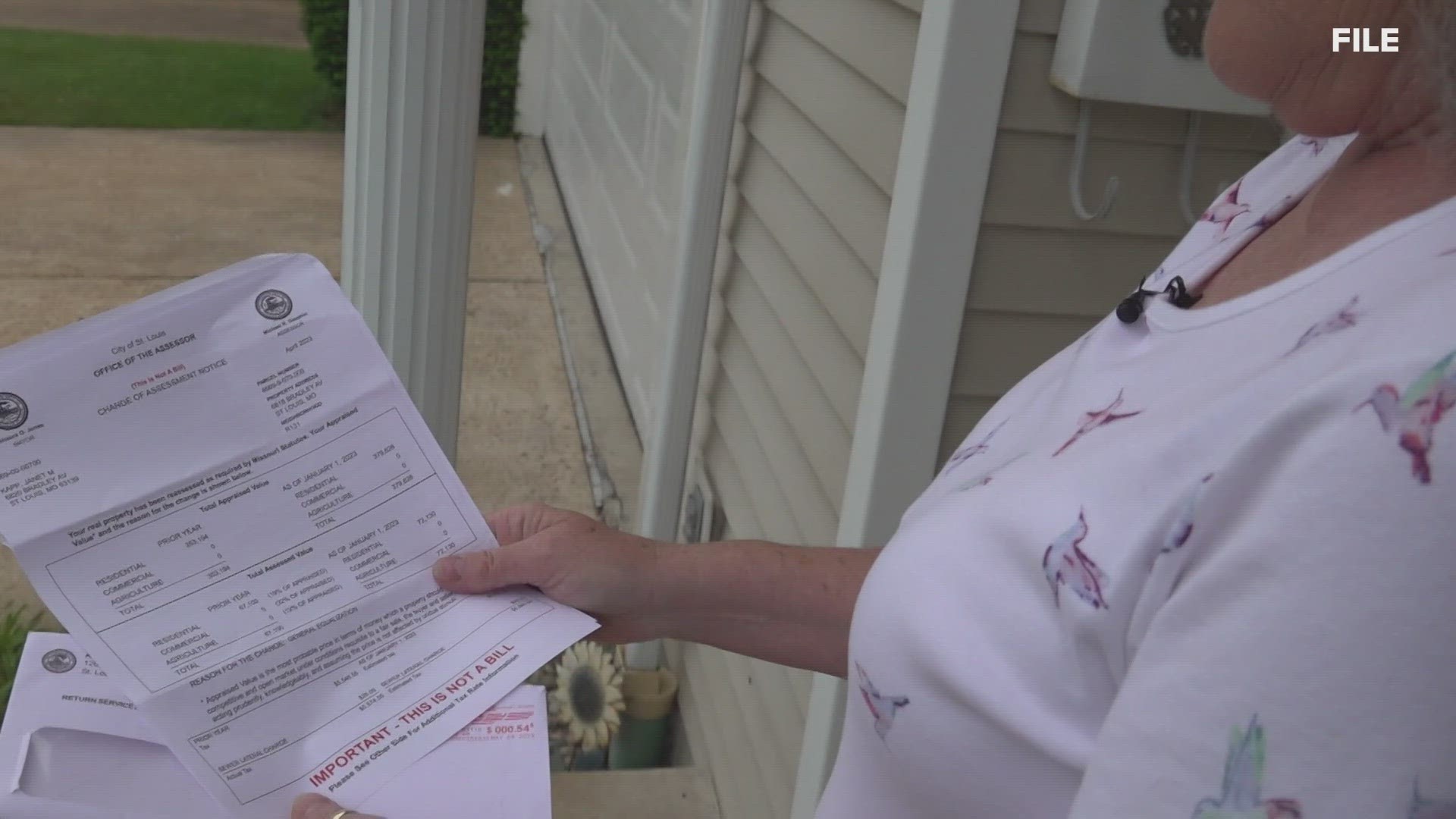

ST. CHARLES COUNTY, Mo. — Some seniors in St. Charles County may soon get tax relief through a property tax freeze if they qualify for the county's new program.

The county announced Monday that applications for the county's senior property tax freeze are now open. The freeze comes after Missouri Gov. Mike Parson passed a law in 2023 that allowed counties to enact the property freeze.

PREVIOUS COVERAGE: St. Charles County Council passes property tax freeze for seniors

How to apply for St. Charles County's senior property tax freeze:

A county spokesperson said seniors interested in applying for the tax freeze have multiple options to choose from, including:

- Paper applications are available in person at the County Administration Building at 201 Second Street.

- An application can also be requested by mail. Those interested can send a written request to the St. Charles County Collector's Office at 201 Second Street, Suite 134 in St. Charles. The letter is also required to include a self-addressed, stamped return envelope along with the request.

- An online form is also available on the county's website. The completed form can be sent to PropTaxFreeze@sccmo.org or sent by mail to the Collector of Revenue's Office.

One of the home's owners must have been at least 62 years old or older on Jan. 1, the county said. Applicants must also provide a government-issued photo ID with their date of birth and a deed showing ownership of the home.

"Once a 2024 application is approved, senior residents must reapply annually for the tax relief program," the county said.

The City of St. Louis made a similar announcement Monday.

Top St. Louis headlines

Get the latest news and details throughout the St. Louis area from 5 On Your Side broadcasts here.